How to invest in IPO through Zerodha: Initial Public Offerings (IPOs) are exciting opportunities for investors to purchase company shares before they are available for trading on the stock exchange. Zerodha, one of India’s leading online brokerage platforms, provide a convenient way for investors to participate in IPOs. In this comprehensive guide, we’ll walk you through the process of investing in an IPO through Zerodha, covering everything from account setup to placing your order.

Steps (How to invest in IPO through Zerodha):

Step 1: Open an Account with Zerodha:

If you still need to, the first step is to open a demat account with Zerodha. You can do easily through their website by filling out the necessary forms and providing the required documents. (how to invest in IPO through Zerodha)

Step 2: Check IPO Availability (how to invest in IPO through Zerodha)

Once your Zerodha account is set up and funded, you can check the availability of IPOs through the Zerodha website or mobile app. IPOs are typically listed under the ‘IPO’ section, where you can find information about upcoming IPOs, including their issue dates, price band, and lot size.

Step 3: Place Your Bid:

After selecting the IPO you wish to invest in, you must place your bid. This involves specifying the number of shares you want to purchase and the price you’re will to pay within the price band set by the company. Remember that Zerodha allows you to place bids only during the IPO’s subscription period.

Step 4: Payment Authorization (how to invest in IPO through Zerodha)

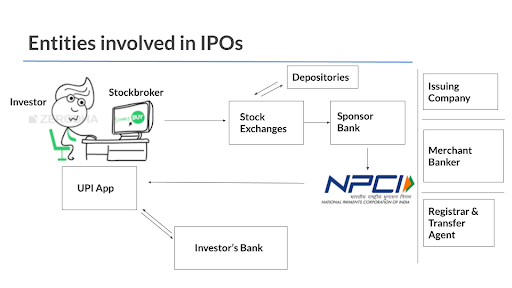

Once you’ve placed your bid, you must authorize the payment for your IPO application. Zerodha offers various payment options, including net banking, UPI, and IMPS, to facilitate seamless transactions.

Step 5: Allocation and Allotment:

After the IPO subscription period closes, the company will allocate shares based on demand and other factors. Zerodha will notify you of the allotment status through email and SMS. If your bid is successful, the allotted shares will be credited to your demat account.

Step 6: Listing and Trading:

Once IPO shares are credited to your demat account, you can hold them long-term or sell them on the stock exchange. Zerodha provides a user-friendly platform for trading shares, allowing you to buy and sell orders efficiently.

FAQ (How to invest in IPO through Zerodha):

Q: Can I apply for an IPO through Zerodha’s mobile app?

A: Yes, Zerodha’s mobile app allows you to apply for IPOs conveniently from your smartphone.

Q: How do I know if my IPO application is successful?

A: Zerodha will notify you via email and SMS about the status of your IPO application, including whether your bid was successful and the number of shares allotted to you.

Q: Can I sell my allotted IPO shares immediately after listing?

A: Yes, you can sell your IPO shares as soon as they are credited to your demat account and listed on the stock exchange.

Q: Are there any charges for applying for an IPO through Zerodha?

A: Zerodha does not charge any brokerage fees for applying for an IPO. However, standard transaction charges may apply.

Conclusion:

Investing in IPOs through Zerodha offers investors a straightforward and convenient way to access new opportunities in the stock market. By following the steps outlined in this guide, you can easily participate in IPOs and potentially capitalize on promising investment prospects.

Disclaimer: Investing in IPOs involves risks, including the risk of losing your investment. It’s essential to conduct thorough research and seek professional advice before making any investment decisions. Zerodha does not guarantee IPO applications’ success or IPO shares’ performance in the secondary market.

You Also Read :

Pre-IPO Investing India: Step-by-Step Process Across Different Platforms

Top Growth Stocks Under $10: Unlocking Investment Opportunities