How to invest in IPO through upstox: Investing in Initial Public Offerings (IPOs) has gained significant popularity among retail investors as it offers an opportunity to be part of a company’s growth story from an early stage. Upstox, one of the leading discount brokers in India, provides a seamless and straightforward platform for investors looking to participate in IPOs. Here’s a detailed guide on how to invest in IPOs through Upstox, including a step-by-step process.

Step-by-Step Process (How to invest in IPO through upstox):

Step 1. Open an Upstox Account:

To invest in IPOs through Upstox, you first need to have an active trading and Demat account with them. If you don’t have one, you can sign up on their website or mobile app by providing the necessary details and documents.

Step 2. Login to Your Account:

Once your account is activated, log in to the Upstox app or website using your credentials.

Step 3. Navigate to the IPO Section:

Look for the ‘Invest in IPO’ option. On the mobile app, this is usually found under the ‘Discover’ or ‘Invest’ section. (How to invest in IPO through upstox)

Step 4. Select the IPO:

A list of open and upcoming IPOs will be displayed. Choose the IPO you wish to invest in by clicking on it.

Step 5. Fill in the Application:

Enter the number of lots you wish to apply for and your bid price. The bid price is the price per share you are willing to pay. You can bid at the cut-off price or any price within the price band. (How to invest in IPO through upstox)

Step 6. UPI Payment:

After submitting your bid, you will receive a payment request on your UPI app. Approve the request to block the bid amount in your bank account. The amount will only be deducted if you are allotted the shares.

Step 7. Confirmation:

Once your application is submitted, you will receive a confirmation. You can check the status of your application in the ‘IPO Application’ section.

Step 8. Allotment:

If you are allotted the shares, they will be credited to your Demat account. If not, the blocked amount will be released.

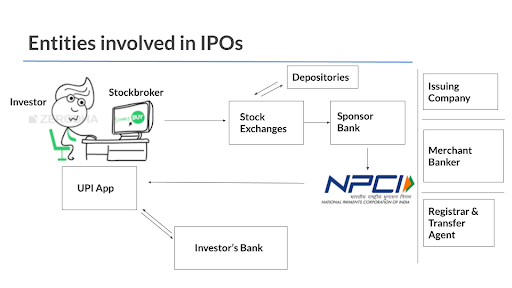

Flow Chart (How to invest in IPO through upstox):

FAQ (How to invest in IPO through upstox):

Q1: How long does it take for an IPO application through Upstox?

A1: The application process itself is quick, but the allotment process can take around 7-10 days post the IPO closure date.

Q2: Can I modify my IPO application?**

A2: Yes, you can modify or cancel your IPO application before the IPO bidding period closes.

Q3: Is it guaranteed that I will receive an allotment if I apply for an IPO?**

A3: No, allotment is not guaranteed. It depends on the demand for the IPO and the number of applications received.

Q4: What happens if I don’t get an allotment?**

A4: If you don’t get an allotment, the blocked amount in your bank account will be released.

Conclusion:

Investing in IPOs through Upstox is a straightforward process that offers retail investors an opportunity to participate in a company’s initial public offering. By following the steps outlined above and keeping the FAQs in mind, investors can navigate the process efficiently.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in IPOs involves risks, including the loss of principal. Investors should conduct their own research or consult with a financial advisor before making investment decisions. The process and features mentioned may be subject to changes as per Upstox’s policies or regulatory guidelines.

You Also Read :

How to invest in IPO through Zerodha ? A Step-by-Step Guide

Pre-IPO Investing India: Step-by-Step Process Across Different Platforms

Top Growth Stocks Under $10: Unlocking Investment Opportunities

Best small cap mutual funds to invest for long term in 2024

How much to invest in cryptocurrency for beginners