How to Open a Demat Account in SBI Bank: Opening a Demat account with the State Bank of India (SBI) can be bright for those looking to step into stock trading and investments. SBI, one of India’s largest and most trusted banks, offers a seamless and secure process to open a Demat account. Here’s a detailed guide to help you through the process and a flow chart.

Step-by-Step Process: (How to Open a Demat Account in SBI Bank)

Visit the Official SBI Website or Branch:

Start by visiting SBI’s official website dedicated to Demat services or a nearby SBI branch. Online registration is quicker, but seeing a branch can be helpful if you need assistance.

Choose the Right Type of Account:

Decide whether you need a Demat account, a trading account, or both. A Demat account holds shares and securities in digital format, while a trading account is used to buy or sell them.

Complete the Application Form:

Fill in the online application form with all required details, including personal information, bank account details, and KYC (Know Your Customer) information.

Submit KYC Documents:

Upload or submit copies of KYC documents, such as your PAN card, Aadhaar card, address proof, and income proof. These documents are essential for verification purposes.

In-Person Verification (IPV):

Depending on the current policy, SBI may require IPV, which can be completed through a video call or by visiting the branch.

Review and Sign the Agreement:

Review the rights and obligations document provided by SBI. Sign the agreement form digitally or physically, as required.

Wait for Account Activation:

Your account will be processed after submitting all documents and completing the verification process. This may take a few days.

Receive Your Demat Account Details:

Once your account is activated, you will receive your Demat account number and other details via email or SMS.

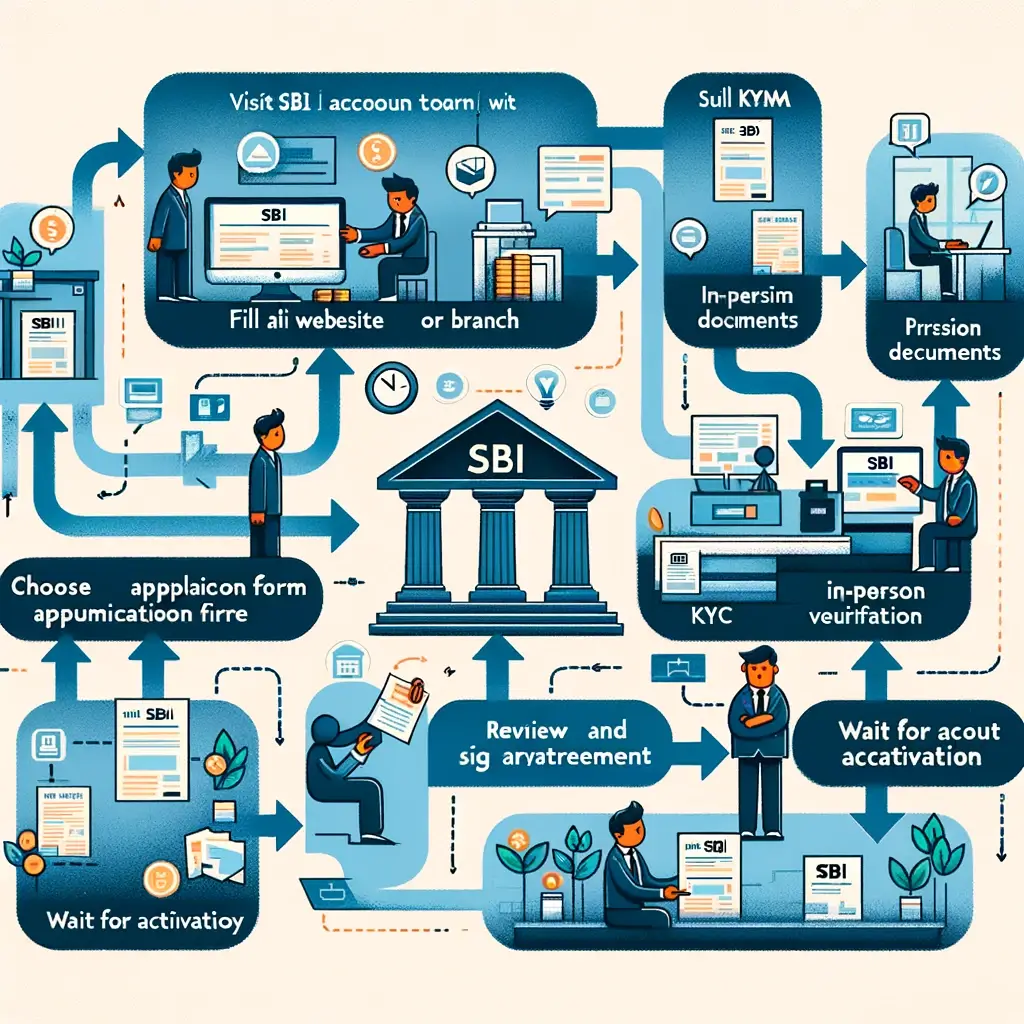

Flow Chart (How to Open a Demat Account in SBI Bank):

Visit the SBI Website or Branch

|

Choose Account Type

|

Fill Application Form

|

Submit KYC Documents

|

In-Person Verification

|

Review and Sign the Agreement

|

Wait for Account Activation

|

Receive Demat Account Details

FAQs (How to Open a Demat Account in SBI Bank):

Q. What documents are needed to open a Demat account in SBI?

A. PAN card, Aadhaar card (for address proof), recent photographs, income proof (if required), and bank account details.

Q. Can I open a Demat account in SBI online?

A. you can initiate the process online through the SBI Demat services website but may need to complete specific steps, like IPV, offline.

Q. Is there any fee for opening a Demat account in SBI?

A. SBI may charge account opening fees along with annual maintenance fees. These can vary, so check the latest fees on SBI’s website.

Q. How long does it take to open a Demat account in SBI?

A. It typically takes a few days after submitting all necessary documents and completing the verification process.

Conclusion:

Opening a Demat account in SBI is a straightforward process that can significantly enhance your investment journey. By following the steps outlined above and preparing the necessary documents, you can ensure a smooth and hassle-free account opening experience.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice. The process and fees associated with opening a Demat account in SBI are subject to change. Always refer to the official SBI website or contact an SBI bank.

You Also Read :

Pre-IPO Investing India: Step-by-Step Process Across Different Platforms

Top Growth Stocks Under $10: Unlocking Investment Opportunities